ATM fraud: how to tell if a cashpoint has been tampered with

https://www.lovemoney.com/news/51953/atm-fraud-how-to-tell-if-a-cashpoint-has-been-tampered-with

From Lebanese loops to pinhole cameras, here are six signs an ATM has been tampered with by criminals.

Before you withdraw cash, it's always worth taking a few seconds to check the machine you're about to use hasn't been tampered with by criminals.

If you spot any of these six signs, avoid that ATM and seek out another one.

Pinhole cameras

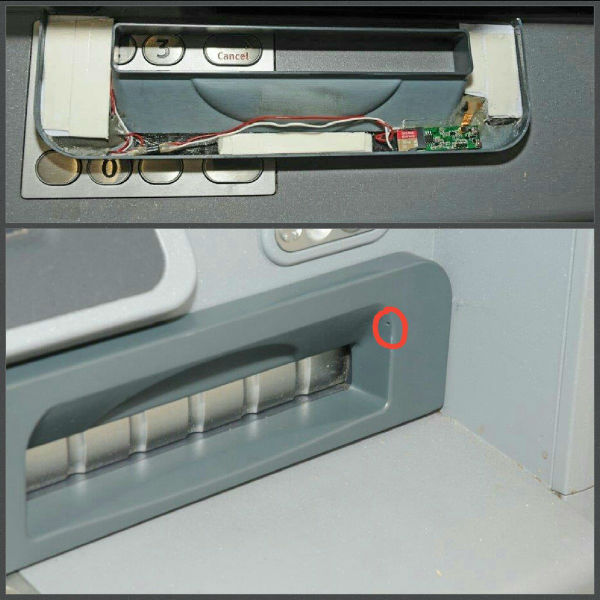

Scammers have been known to hide tiny pinhole cameras in cash machines to record people's PINs.

City of London Police issued the photos below after spotting hidden cameras across central London ATMs.

This one was hidden inside a fake cash-dispensing slot cover, recording the keypad as people keyed in their details.

Photo credit: City of London Police

Police are telling people to stay sharp when they’re getting cash out: always cover your hand when you enter your PIN.

Before you even enter your details, check the cash machine for loose parts, including the card slot and keypad.

Photo credit: City of London Police

Don’t try and remove the camera yourself as the criminals in question could be hanging around near the machine and might confront you.

Fake fronts

In some cases, criminals place card or cash capture devices and PIN compromise devices in or around ATMs to get quick access to your cash.

A few sneaky scammers will even put on entire false fronts to capture unsuspecting people’s PINs and money, Fico told This is Money.

They’re often really well disguised so have a thorough check of the ATM before you start using it.

Photo credit: Fico

A wider card slot than normal

You’re right to be concerned about an unusually bulky card slot, as this could contain a ‘skimmer’.

This tool is attached to the ATM’s card slot that secretly takes your card details when you’re making a withdrawal. Apart from its width, it’s really difficult to distinguish it from a normal card slot.

Keep an eye out for misaligned or misprinted stickers - it’s often an attempt to cover up where a compromise device has been installed.

Photo credit: Fico

A loose or blocked card slot

This may be a sign of a ‘Lebanese Loop’. Criminals will try and trap your card in the machine by placing a tiny plastic device or sleeve with a barb into the card reader so that when you try and withdraw money, your card will get stuck.

Photo credit: Fico

The ATM will keep asking for a PIN as it can’t read the card, leading you to believe that your card has been swallowed and walk away. That gives the fraudsters the perfect opportunity to swoop in and take your card.

Loose PIN pad

Be wary if the PIN pad feels loose, thick or sponge-like. This crafty trick is known as ‘pin-pad overlay’ - the real PIN pad is covered by a fake which does record your PIN correctly just like any other machine but also captures your details for the fraudster.

In some cases, numbers are instantly transferred by WiFi to a waiting accomplice so that they can record it and use it later.

Loitering groups of strangers

This warning is nothing new but is still vitally important: be aware of what’s going on around you. Don’t accept help from strangers and don’t allow yourself to get distracted.

Scammers often work in teams and they rely on distraction to catch their victims out.

It's a good idea not to use cash machines near a group of people who are inexplicably loitering.

If something goes wrong they may become oddly helpful and when one is trying to assist you, the others may look at your PIN or swipe your card or cash.

Get clued up on scams:

KEEP YOUR MONEY SAFE

Get paid up to £150 to switch current accounts. Better customer service, high-interest savings accounts and interest-free overdrafts are all on offer..

Your credit card provider must protect purchases over £100 for free. So make sure you use plastic to be extra safe when you buy pricey items.

No comments:

Post a Comment